As the Indian Rupee nears 90 per dollar amid trade hurdles, this article explores the implications for your savings, investments, and daily expenses. Understand how to safeguard your financial future.

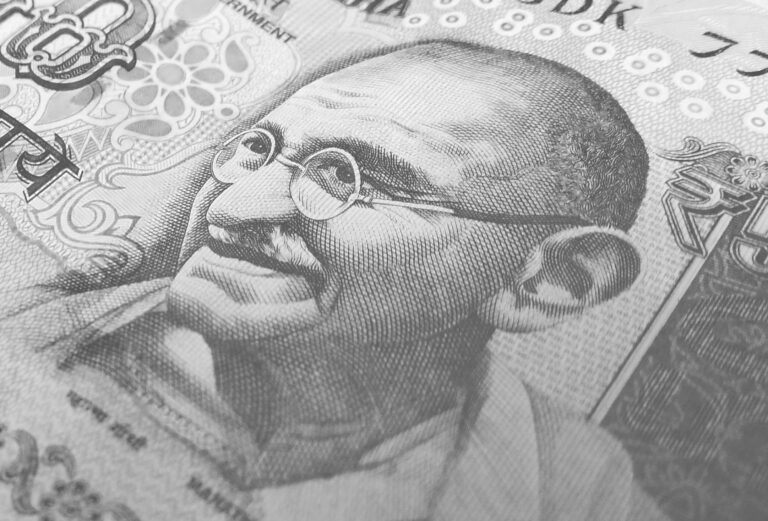

The financial landscape for many individuals in India is currently defined by a pressing concern: the steady weakening of the Indian Rupee against major global currencies, particularly the US dollar. Recent reports from a major financial news outlet on December 2, 2025, highlight that the Indian Rupee has tested a new all-time low of 89.9538 per dollar, even weakening further to 90.15 in offshore markets. This significant development stems largely from persistent delays in finalizing a crucial trade accord with Washington, aimed at reducing one of Asia’s most stringent tariffs. The prospect of the currency slipping past the psychologically significant 90-per-dollar level by year-end, should a trade deal remain elusive, is a stark warning for anyone managing their personal finances and wealth.

For individuals committed to building and preserving wealth, understanding the ramifications of this Indian Rupee Depreciation is paramount. It’s not merely an abstract economic indicator; it directly impacts your purchasing power, the value of your investments, the cost of education abroad, and even your daily living expenses. This article will delve deep into the causes and consequences of a weakening rupee, offering practical strategies and insights to help you navigate this volatile period and protect your financial well-being.

Understanding Indian Rupee Depreciation: Causes and Mechanisms

Currency depreciation occurs when a country’s currency loses value relative to other currencies. In simple terms, it means you need more units of the local currency to buy one unit of a foreign currency. The current slide in the Indian Rupee Depreciation is a multi-faceted issue, driven by both domestic and international factors.

The Role of Trade Deficits and Global Demand

One primary driver of currency depreciation is a sustained trade deficit. When a country imports more goods and services than it exports, it needs to convert more of its local currency into foreign currency to pay for those imports. This increased demand for foreign currency and supply of local currency puts downward pressure on the local currency’s value. India, being a significant importer of essential commodities like crude oil and electronics, often runs a trade deficit, which naturally contributes to Indian Rupee Depreciation.

The current situation, as highlighted by the Bloomberg report, specifically points to the delay in a trade deal with the US. Such a deal would likely involve tariff reductions, potentially boosting India’s exports or making imports cheaper, thus easing the trade balance. Without it, the existing trade imbalance pressures continue to bite.

Capital Outflows and Investor Sentiment

Another critical factor is capital outflows. When foreign investors pull money out of a country’s stock or bond markets, they sell their local currency holdings to convert them into their home currency. This increases the supply of the local currency in the foreign exchange market, leading to depreciation. Factors influencing capital outflows include:

- Interest Rate Differentials: If interest rates in other major economies (like the US) are rising, investors might move their money there to seek higher returns, often called “carry trade” reversals.

- Geopolitical Risks: Regional or global instability can make investors cautious, prompting them to move funds to safer havens.

- Economic Outlook: A dimming economic outlook or policy uncertainty within a country can deter foreign investment and even trigger outflows.

- Global Dollar Strength: The US dollar often acts as a safe-haven currency during times of global uncertainty. If global investors flock to the dollar, it naturally strengthens against other currencies, including the rupee.

Monetary Policy and Inflation

A central bank’s monetary policy also plays a significant role. If a central bank keeps interest rates low, it can make a currency less attractive to foreign investors seeking higher returns. Conversely, raising rates can attract foreign capital, strengthening the currency. However, central banks must balance currency stability with domestic economic growth and inflation control.

Inflation, particularly high inflation, erodes the purchasing power of a currency. If a country’s inflation rate is significantly higher than its trading partners, its currency tends to depreciate over time as it can buy less. The interplay between inflation and exchange rates is a continuous tug-of-war for policymakers.

Impact of Indian Rupee Depreciation on Your Personal Wealth

The direct consequences of a weakening rupee extend far beyond economic headlines, touching various aspects of an individual’s financial life. Understanding these impacts is the first step toward effective wealth preservation.

Erosion of Purchasing Power and Inflationary Pressures

One of the most immediate and tangible effects of Indian Rupee Depreciation is the increased cost of imported goods. For a country that relies on imports for a significant portion of its consumption—from crude oil that influences fuel prices and transportation costs, to electronics, machinery, and even certain food items—a weaker rupee makes everything more expensive.

- Daily Essentials: Fuel prices directly impact the cost of transport, which in turn affects the prices of all goods, leading to higher food and consumer product costs.

- Manufacturing Inputs: Industries that rely on imported raw materials or components face higher input costs, which are then passed on to consumers, fueling domestic inflation.

- Overall Inflation: This import-led inflation reduces the real purchasing power of your income and savings. The money you have saved will simply buy less than it did before.

Impact on Savings and Investments

The effect on investments is nuanced and depends heavily on the asset class and geographic diversification of your portfolio.

Domestic Equities and Bonds

For investors holding domestic stocks, the impact can be mixed. Export-oriented companies that earn revenue in foreign currencies (like IT services or pharmaceutical exporters) often benefit from a weaker rupee, as their foreign earnings translate into more rupees. This can potentially boost their profitability and stock prices.

Conversely, companies heavily reliant on imported raw materials or components (e.g., automobile manufacturers or certain consumer durable companies) face higher input costs, which can squeeze their profit margins and negatively impact their stock performance. The overall market sentiment can also suffer if the depreciation signals broader economic weakness or policy concerns.

In the debt market, a weakening rupee can put upward pressure on interest rates. To attract foreign capital and stabilize the currency, the central bank might be compelled to raise interest rates, which can impact bond yields and prices. Existing bondholders might see the value of their holdings decline if new bonds are issued at higher rates.

International Investments

Ironically, those who have diversified their portfolios to include international assets can benefit. If you hold investments in foreign stocks, bonds, or real estate, and those assets are denominated in stronger currencies (like the US dollar), their value in rupee terms will increase as the rupee depreciates. This highlights the critical importance of geographic diversification as a hedge against local currency risks.

Real Estate

The real estate sector can experience mixed effects. For Non-Resident Indians (NRIs) looking to invest in property back home, a weaker rupee means their foreign currency savings can buy more in India, potentially stimulating NRI investments. However, for domestic buyers, if construction costs rise due to imported materials, property prices could increase. If inflation and interest rates rise significantly, domestic demand for real estate might soften due to higher borrowing costs.

Costs of Education and Travel Abroad

For families planning or currently supporting education abroad, a weakening rupee presents a significant challenge. Tuition fees, living expenses, and other costs denominated in foreign currency become substantially more expensive. A course that cost 50,000 USD now requires more rupees than before, placing additional financial strain on families.

Similarly, international travel becomes pricier. Flights, accommodation, and expenses in foreign countries cost more in rupee terms, potentially deterring overseas vacations or business trips.

Impact on Debt and Remittances

Individuals or companies with loans denominated in foreign currencies will find their repayment burden increasing as the rupee depreciates. While foreign currency loans often come with lower interest rates, the exchange rate risk can quickly negate these advantages, leading to significantly higher effective costs.

On the flip side, individuals receiving remittances from relatives working abroad will benefit. Their foreign currency receipts will convert into a larger sum of rupees, boosting their financial inflows.

Strategies for Navigating Indian Rupee Depreciation and Protecting Wealth

In the face of ongoing Indian Rupee Depreciation, proactive financial planning and strategic adjustments to your wealth management approach are crucial. Here are several strategies to consider.

1. Embrace Diversification: Beyond Borders and Asset Classes

Diversification is the cornerstone of robust wealth management, and its importance is magnified during periods of currency volatility.

Geographic Diversification: Investing Internationally

One of the most effective hedges against local currency depreciation is to diversify a portion of your portfolio into international assets. This means investing in companies, funds, or bonds denominated in stronger foreign currencies. As the rupee weakens, the value of these foreign assets, when converted back to rupees, increases.

- Global Equity Funds: Consider investing in mutual funds or Exchange Traded Funds (ETFs) that track global indices or invest in companies listed in developed markets like the US, Europe, or other strong economies.

- Foreign Bonds: While more complex for individual investors, some platforms offer access to international bond funds or sovereign bonds.

- Commodities: Assets like gold and silver are often denominated in US dollars and tend to act as safe havens during economic uncertainty and currency fluctuations. Holding a portion of your portfolio in physical gold or gold ETFs can offer a degree of protection.

Asset Class Diversification: Balancing Risks

Beyond geography, ensure your portfolio is diversified across various asset classes:

- Equities: As mentioned, favor export-oriented sectors or companies with strong balance sheets that can withstand higher import costs.

- Debt: While higher interest rates might seem attractive, also consider short-term debt instruments to avoid being locked into lower rates if central banks continue to hike.

- Real Estate: If considering real estate, evaluate its potential for rental income and capital appreciation, considering the broader economic climate.

2. Smart Spending and Budgeting Adjustments

When imports become more expensive, adjusting your spending habits can help mitigate the impact on your household budget.

- Prioritize Local: Whenever possible, opt for domestically produced goods and services over imported ones. This reduces your exposure to rising import costs.

- Review Discretionary Spending: Re-evaluate non-essential expenditures, especially those involving imported luxury goods or services.

- Energy Conservation: Since crude oil is a major import, conserving energy directly reduces your exposure to higher fuel costs.

3. Review and Adjust Your Investment Portfolio

Regularly reviewing your investment portfolio is always good practice, but it becomes critical during periods of significant economic shifts. Reassess your risk tolerance and investment objectives in light of the Indian Rupee Depreciation.

- Rebalance: If your international holdings have appreciated significantly in rupee terms, you might need to rebalance to maintain your desired asset allocation.

- Sectoral Analysis: Identify sectors that are likely to benefit (exporters) and those that might suffer (heavy importers) from a weaker rupee. Adjust your exposure accordingly.

- Professional Advice: Consider consulting with a qualified financial advisor who can provide personalized guidance based on your specific circumstances and goals.

4. Strategic Debt Management

If you have loans, particularly those linked to foreign currencies or floating interest rates, a strategic approach to debt management is vital.

- Prioritize High-Cost Debt: Focus on repaying any foreign currency loans or high-interest domestic loans faster, if feasible, to reduce your exposure to rising costs.

- Fixed vs. Floating Rates: If interest rates are expected to rise, converting floating-rate loans to fixed-rate loans (if available and beneficial) could provide stability, though this comes with trade-offs.

5. Optimize for Education and Travel Abroad

For those with future expenses in foreign currency, specific strategies can help.

- Early Savings in Foreign Currency: If you anticipate significant foreign currency expenses (e.g., child’s education abroad), consider starting a savings plan in a foreign currency account or investing in foreign currency-denominated assets. This acts as a natural hedge.

- Staggered Remittances: Instead of sending a lump sum, consider converting funds for education or travel in smaller tranches over time, to average out the exchange rate fluctuations.

- Scholarships and Grants: Actively explore scholarships and grants that can help offset the rising costs of international education.

6. Explore Income Generation in Stronger Currencies

For individuals with skills marketable internationally, exploring opportunities to earn in stronger currencies can provide a direct hedge against Indian Rupee Depreciation.

- Freelancing/Consulting: Offer your services to international clients and get paid in currencies like USD, EUR, or GBP.

- Remote Work: Seek remote job opportunities with international companies.

- Export-Oriented Businesses: If you have an entrepreneurial bent, consider ventures that cater to international markets.

7. Build and Maintain a Robust Emergency Fund

An adequate emergency fund is always important, but particularly so during times of economic uncertainty. It provides a buffer against unexpected expenses and allows you to avoid liquidating investments at unfavorable times. Consider keeping a portion of this fund in highly liquid, stable assets, possibly even a small part in a foreign currency deposit account if your financial circumstances permit and you have anticipated foreign currency needs.

Government and Central Bank Responses to Currency Pressure

The government and the central bank do not sit idly by when the currency faces significant pressure. Their actions play a crucial role in shaping the economic environment and can influence the trajectory of the Indian Rupee Depreciation.

Monetary Policy Interventions

The central bank typically has several tools at its disposal:

- Interest Rate Adjustments: Raising interest rates can make local currency assets more attractive to foreign investors, potentially increasing capital inflows and strengthening the currency. However, this must be balanced against its impact on domestic economic growth and borrowing costs.

- Foreign Exchange Market Intervention: The central bank can directly intervene in the foreign exchange market by selling its foreign currency reserves (typically US dollars) to buy rupees. This increases the demand for rupees, helping to shore up its value. This is a common tactic but has limits based on the size of a country’s reserves.

- Liquidity Management: Adjusting the liquidity in the banking system can influence short-term interest rates and capital flows.

Fiscal and Trade Policy Measures

The government can implement fiscal and trade policies to support the currency:

- Trade Deals: Actively pursuing trade agreements, like the one with the US mentioned in the Bloomberg report, is critical. Successful deals can boost exports, reduce trade deficits, and improve investor confidence.

- Export Promotion: Implementing policies and incentives to encourage domestic exports can help increase foreign currency earnings.

- Fiscal Prudence: Maintaining fiscal discipline, managing government debt, and controlling deficits can bolster investor confidence in the economy, reducing capital flight.

- Attracting Foreign Direct Investment (FDI): Creating a favorable environment for FDI can bring in long-term capital, providing stable foreign currency inflows that support the rupee.

The delay in the US trade deal clearly illustrates how governmental policy and international relations directly impact currency stability and, by extension, individual wealth. The outcome of such negotiations can significantly alter the economic outlook.

Long-Term Outlook and India’s Economic Fundamentals

While the immediate concerns surrounding Indian Rupee Depreciation are valid, it’s also important to consider India’s underlying economic fundamentals and long-term growth prospects. Despite short-term volatility, India remains one of the fastest-growing major economies globally.

Demographic Dividend and Domestic Demand

India possesses a young and growing population, often referred to as a “demographic dividend.” This large working-age population contributes to a robust domestic consumption base, which is a significant driver of economic growth. A strong domestic market provides resilience against global economic headwinds.

Structural Reforms and Infrastructure Development

Ongoing structural reforms in various sectors, coupled with massive investments in infrastructure development (roads, railways, ports, digital connectivity), are expected to enhance productivity, improve the ease of doing business, and attract further investment in the long run. These foundational changes can strengthen the economy’s ability to withstand external shocks.

Technological Advancement and Digitalization

India’s rapid adoption of digital technologies, from digital payments to e-governance, is transforming its economy, making it more efficient and inclusive. The thriving technology and startup ecosystem also contributes to innovation and economic diversification.

While currency movements can create near-term challenges, a strong and growing economy, coupled with proactive policy measures, typically provides a foundation for long-term currency stability and appreciation. However, the path to stability is rarely linear, and individuals must remain vigilant and adapt their financial strategies accordingly.

Conclusion: Proactive Wealth Management in a Volatile Currency Landscape

The Indian Rupee’s current proximity to the 90-per-dollar mark, driven by specific trade impasses, serves as a powerful reminder of how global economic forces can directly influence personal financial stability. The Indian Rupee Depreciation is not merely an abstract economic event but a tangible factor that can erode purchasing power, impact investment returns, and increase the cost of essential services.

For individuals striving to build and preserve wealth, the key takeaway is the absolute necessity of proactive and adaptable financial planning. This includes strategic diversification of investments across geographies and asset classes, prudent management of debt, careful budgeting, and a keen eye on global economic developments. While governments and central banks work to stabilize the currency, individual investors have the power to implement strategies that protect their financial future.

By understanding the mechanisms behind currency depreciation, assessing its impact on various aspects of your wealth, and diligently applying the strategies outlined, you can navigate these challenging times with greater confidence. The goal is not just to survive currency volatility but to emerge from it with your wealth not only protected but potentially enhanced through informed decision-making.

Frequently Asked Questions

How can the Indian Rupee Depreciation impact my daily budget and spending?

The depreciation of the Indian Rupee directly increases the cost of imported goods and services. This means products like fuel, electronics, and even certain food items (if they rely on imported components or raw materials) become more expensive. This leads to higher inflation, reducing your overall purchasing power and making your existing income and savings buy less. Your daily expenses for transportation, groceries, and consumer goods may see an upward trend, putting pressure on your household budget.

What investment strategies can help protect my wealth from further Indian Rupee Depreciation?

To protect your wealth from further Indian Rupee Depreciation, consider diversifying your investment portfolio. This includes geographic diversification by investing a portion of your wealth in international assets like global equity funds, foreign bonds, or commodities such as gold, which are often denominated in stronger currencies like the US dollar. Additionally, within the domestic market, prioritize investments in export-oriented companies that benefit from a weaker rupee, as their foreign earnings translate to more rupees.

Will my child’s overseas education become significantly more expensive due to a weakening rupee?

Yes, a weakening rupee will make overseas education significantly more expensive. Tuition fees, accommodation, and living expenses, which are typically denominated in foreign currencies (e.g., USD, GBP, EUR), will require a larger amount of Indian Rupees to cover. For example, if a year of tuition costs 50,000 USD, a weaker rupee means you will need to exchange more rupees to obtain that same dollar amount, increasing the overall financial burden for families.

How does the government typically respond to significant Indian Rupee Depreciation?

Governments and central banks typically respond to significant Indian Rupee Depreciation through a combination of monetary and fiscal measures. The central bank might raise interest rates to attract foreign capital or intervene directly in the foreign exchange market by selling foreign currency reserves to buy rupees. The government might focus on pursuing trade deals (like the one with the US mentioned in the article) to boost exports, manage trade deficits, attract foreign direct investment, and maintain fiscal discipline to bolster investor confidence.

Should I consider moving all my investments out of India due to the currency concerns?

While diversifying internationally is a prudent strategy to mitigate risks from Indian Rupee Depreciation, moving all investments out of India is generally not recommended. India’s economy still offers strong long-term growth potential due to its demographic dividend, structural reforms, and burgeoning domestic market. A balanced portfolio that includes both domestic and international assets allows you to benefit from local growth while hedging against currency fluctuations. Consulting a financial advisor can help tailor a diversification strategy appropriate for your individual risk tolerance and financial goals.