Explore the potential for substantial wealth creation through strategic investments in the nascent quantum computing market. Understand the technologies and growth trajectories.

The landscape of technological innovation is constantly shifting, presenting new frontiers for investment and wealth creation. Among these, quantum computing stands out as a particularly disruptive force, poised to redefine industries ranging from finance and healthcare to materials science and artificial intelligence. For astute investors, understanding the intricacies of quantum computing stocks now could position them for substantial financial growth in the coming decades.

While still in its nascent stages, the quantum computing market exhibits all the hallmarks of a secular growth trend, attracting significant capital and talent. Early movers in this highly specialized field are laying the groundwork for what could become the next trillion-dollar industry. However, investing in such cutting-edge technology also comes with inherent volatility and a steep learning curve. This article delves into what quantum computing entails, why it matters for your investment portfolio, and highlights key players that could potentially drive significant returns for long-term investors.

The promise of quantum computing is immense, but so are the challenges. Many of the companies pioneering this space are characterized by rapid innovation, volatile revenues, considerable operating losses, and often high valuations. Yet, for those with a long-term vision and a willingness to embrace risk, the opportunity to participate in a foundational technological shift through quantum computing stocks is compelling.

Decoding Quantum Computing: A Paradigm Shift for Wealth

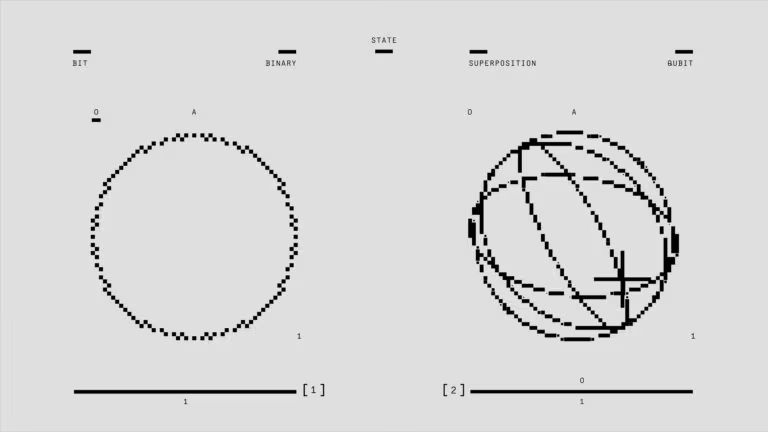

To appreciate the investment potential of quantum computing stocks, it is crucial to first grasp the fundamental difference between classical and quantum computing. Traditional computers, the ones we use daily, store information in bits, which can represent either a 0 or a 1 at any given time. This binary system has powered our digital world for decades, performing calculations sequentially and efficiently for a vast array of tasks.

Quantum computers, on the other hand, operate on principles derived from quantum mechanics. They utilize “qubits,” which are far more complex than classical bits. A qubit can represent a 0, a 1, or, astonishingly, both a 0 and 1 simultaneously through a phenomenon known as “superposition.” This ability allows quantum computers to process and store exponentially more information than classical computers. Furthermore, qubits can interact with each other in a process called “entanglement,” creating highly correlated states even when physically separated. This entanglement allows for incredibly complex calculations to be performed in parallel, leading to a computational power that dwarfs even the most powerful supercomputers for specific types of problems.

While the theoretical power of quantum computers is extraordinary, their practical application is still limited. They are currently much more expensive to build and operate, physically larger, less power-efficient, and significantly more prone to errors than classical computers. These limitations mean that quantum computers are primarily deployed in highly specialized research projects within academic institutions, governmental laboratories, and corporate R&D divisions, rather than in mainstream computing applications.

For quantum computing to achieve widespread adoption, significant advancements are needed to make these systems cheaper, smaller, and more scalable, while simultaneously reducing their error rates. The race is on, with various companies employing different technological approaches to achieve a stable quantum state. The ultimate winner in this technological competition remains uncertain, underscoring the speculative nature of investing in this sector.

The Quantum Market’s Explosive Growth Trajectory

Despite the current challenges, the long-term outlook for quantum computing is exceptionally bright. Industry analysts project substantial growth, driven by increasing applications across diverse sectors. According to analysis by Fortune Business Insights, the global quantum computing market is expected to expand at a compound annual growth rate (CAGR) of 34.8% from 2025 to 2032. This forecast highlights quantum computing as a significant secular growth trend for the broader technology sector.

This rapid expansion is fueled by the technology’s potential to revolutionize complex problem-solving. Imagine drug discovery accelerated by simulating molecular interactions at an unprecedented level, financial models optimizing portfolios with greater precision, or artificial intelligence algorithms achieving new levels of learning. These are the promises that drive investment and innovation in the quantum space.

For investors focused on wealth creation, identifying and investing in the companies that are best positioned to capitalize on this growth early on is key. While the market is still developing, the potential for early investments in leading quantum computing stocks to yield substantial returns as the industry matures is a significant draw.

Leading Quantum Computing Stock Innovators

Several ambitious companies are vying for leadership in the quantum computing market, each pursuing distinct technological pathways. Understanding these different approaches is critical for evaluating their long-term potential as investment opportunities. Here, we examine three prominent players, focusing on their technology, market position, and growth prospects.

Pioneer in Electron-Driven Systems: Rigetti Computing (a specialized quantum company)

One of the key players in the quantum computing sector is a company specializing in electron-driven systems. This firm accelerates electrons through “superconducting loops” to achieve a quantum state. This particular approach has several notable characteristics that influence its market position and potential as an investment in quantum computing stocks.

Technology and Advantages: Electron-driven superconducting loop systems are recognized for being relatively inexpensive to manufacture compared to some other quantum architectures. This manufacturing efficiency contributes to their scalability, a critical factor for wider adoption. Many larger technology companies, including some of the most recognized names in computing, also utilize electron-driven superconducting loops in their quantum systems because they are considered more scalable than certain other types of systems. This company develops both modular and non-modular quantum processing units (QPUs), which are the core components of a quantum computer. Beyond hardware, it also provides a cloud platform, enabling developers to create and test quantum algorithms, thereby expanding its ecosystem.

Challenges: A significant challenge for electron-driven systems is their operational cost. They require cryogenic refrigeration, meaning they must be kept at extremely low temperatures, often just fractions of a degree above absolute zero. This requirement makes them expensive to operate and maintain, limiting their accessibility and deployment in broader applications.

Growth and Financial Outlook: This company has established an early mover’s advantage in the market. While its revenue figures might appear modest in the near term, the long-term projections highlight significant growth potential. For instance, after an estimated $7.6 million in revenue in 2025, analysts project a substantial jump to $20.5 million in 2026 and $45.8 million in 2027, representing a three-year CAGR of approximately 62%. These projections suggest a rapid ramp-up in commercialization as the technology matures. While current valuations may seem high relative to near-term sales, the anticipated growth in market cap, potentially reaching over $11 billion by 2035 at a 30% CAGR, underscores the long-term wealth creation opportunity for investors willing to endure the early volatility.

Innovator in Ion-Trap Systems: IonQ (a leading quantum firm)

Another prominent firm, a leading developer in the quantum space, employs a different and highly precise method: ion-trap technology. This company utilizes meticulously calibrated lasers to trap and manipulate individual ions, bringing them into a quantum state. This distinct approach positions it uniquely within the competitive landscape of quantum computing stocks.

Technology and Advantages: Ion-trap systems are renowned for their superior gate fidelity, meaning they offer higher accuracy in quantum operations compared to many electron-driven systems. An additional advantage is that these systems do not require cryogenic refrigeration, simplifying their environmental requirements compared to superconducting architectures. This reduces some of the infrastructure overhead, albeit introducing other complexities.

Challenges: Despite the absence of cryogenic needs, ion-trap systems present their own operational complexities and costs. They can be expensive to operate because they demand constant recalibration of delicate lasers by specialized teams of experts. The precision required to manipulate individual ions with lasers means that these systems can be highly sensitive and require significant ongoing maintenance and expertise.

Growth and Financial Outlook: This company offers various quantum systems and provides its processing power as a cloud-based service, making its technology accessible to a wider range of users. It benefits from facing fewer direct competitors compared to those in the electron-based quantum computing segment. A growing number of government contracts are a significant driver of its near-term growth, indicating trust and investment from public sector entities in its technology. Financially, this firm shows an impressive growth trajectory. From an estimated $108.6 million in revenue in 2025, projections soar to $197.6 million in 2026 and $316.5 million in 2027, reflecting a robust three-year CAGR of 94%. This aggressive growth profile is mirrored in its potential market cap expansion, which could reach nearly $77.4 billion by 2035, representing a substantial increase for early investors. Such figures highlight the significant wealth potential if the company continues its current growth trajectory and market penetration.

Visionary in Photonic Systems: Quantum Computing Inc. (a specialized chip developer)

Finally, a forward-thinking developer of specialized chips, often referred to by its common market abbreviation, is pioneering photonic quantum computing. This company develops photonic chips that transmit data using light particles, or photons. This approach represents a significant departure from both electron-driven and ion-trap systems, offering unique advantages and challenges within the quantum computing stocks sector.

Technology and Advantages: Photonic chips boast two significant advantages that could prove transformative for quantum computing’s mainstream adoption. First, they can be easily mass-produced using conventional chip fabrication facilities, which could drastically reduce manufacturing costs and accelerate scaling. Second, and crucially, these systems can operate effectively at room temperature, eliminating the need for expensive and energy-intensive cryogenic refrigeration or delicate laser recalibrations. This simplicity in operation and manufacturing could significantly lower the barrier to entry for quantum computing.

Challenges: Currently, photonic chips generally exhibit lower gate fidelity compared to electron- and ion-driven systems. This means they may be less accurate in their quantum operations. However, this is an area of rapid development. The company is actively scaling up production of its newer thin-film lithium niobate (TFLN) photonic chips and preparing to launch its own Dirac-3 quantum system, which could significantly improve fidelity and performance. Its efforts to expand the Qatalyst cloud platform also aim to attract and retain more developers, building a stronger ecosystem around its technology.

Growth and Financial Outlook: While starting from a smaller revenue base, this company demonstrates the most explosive projected growth among the three. From an estimated $0.8 million in revenue in 2025, projections reach $2.8 million in 2026 and an impressive $15.0 million in 2027, translating to an astonishing three-year CAGR of 235%. This high growth rate reflects the potential for rapid scaling as its technology matures and gains wider acceptance. Despite a smaller projected market cap by 2035, around $3.7 billion, this still represents a remarkable increase from its current valuation, underscoring the high-reward potential for investors willing to bet on this rapidly evolving segment of quantum computing stocks.

Navigating the Investment Terrain of Quantum Computing Stocks

Investing in quantum computing stocks requires a clear understanding of both the immense potential and the significant risks involved. This is not a sector for the faint of heart or those seeking immediate, stable returns. It is a frontier investment, demanding patience, a high tolerance for volatility, and a strong conviction in long-term technological disruption.

High Volatility and Speculative Nature

As highlighted, all three companies discussed—and indeed the entire quantum computing sector—remain highly speculative. The underlying technologies are still evolving, and the commercialization path is not fully clear. This uncertainty translates directly into significant stock price volatility. Investors should be prepared for substantial swings in value, often driven by news about technological breakthroughs, funding rounds, partnerships, or competitive developments.

Early-stage markets like quantum computing are characterized by a “winner-take-all” or “winner-take-most” dynamic. While several technologies are being explored, only a few are likely to dominate in the long run. Identifying these winners ahead of time is exceptionally challenging, making investments in individual companies inherently risky.

Valuations and Growth Projections: A Careful Balance

A crucial consideration for any investor looking at quantum computing stocks is the often-lofty valuations. These companies frequently trade at extremely high price-to-sales (P/S) ratios, far exceeding those of established, profitable companies. For example, some may trade at over 150 times their projected sales for several years out. These valuations are not based on current profitability but rather on the immense future potential and the anticipated rapid growth. Such high multiples mean that a significant portion of future growth is already priced into the stock.

The revenue estimates discussed, while impressive, should be taken with a grain of salt. They are projections based on current trends and assumptions that may not materialize exactly as predicted. Achieving these growth rates and justifying current valuations will require flawless execution, sustained innovation, and successful market penetration. Any stumble could lead to a re-evaluation by the market and a significant correction in stock price.

However, if these companies do match or even exceed analyst estimates, and if the quantum computing market indeed expands as anticipated, the long-term wealth creation potential is substantial. The author’s calculations showing potential market caps by 2035, while illustrative, demonstrate the scale of opportunity for patient investors. These projections assume continued high growth rates (e.g., 30% CAGR from 2027 onwards) and a sustained premium valuation (e.g., 30 times current year’s sales) which are demanding but not impossible in rapidly expanding, disruptive markets.

Long-Term Horizon and Due Diligence

Successful investment in quantum computing stocks demands a genuinely long-term investment horizon. This is not a sector for short-term trading. Investors should be prepared to hold these stocks for a decade or more, allowing the underlying technology to mature, the market to develop, and the companies to scale. During this period, there will undoubtedly be significant ups and downs, but the focus must remain on the long-term trajectory.

Furthermore, rigorous due diligence is paramount. Investors should not only understand the financial metrics but also delve into the technological specifics of each company. What are their unique selling propositions? How robust is their intellectual property? Who are their key partners and customers? What are the potential technological hurdles, and how are they addressing them? Staying informed about advancements and competitive shifts in the quantum computing space is crucial for making informed investment decisions.

Diversification: A Prudent Approach

Given the speculative nature and high risk associated with individual quantum computing stocks, it is highly advisable to approach this sector with a diversified strategy. These investments should constitute only a small portion of a broader, well-diversified portfolio. Do not allocate a disproportionate amount of capital that you cannot afford to lose. A balanced portfolio might include more stable, established assets alongside these high-growth, high-risk ventures.

Consider a strategy that allows for exposure to the overall quantum computing theme without solely relying on the success of a single company. This might involve investing in a basket of quantum computing-related companies, or potentially considering broader technology ETFs that might include some exposure to this emerging sector as they grow.

The Road Ahead: Substantial Wealth for the Patient Investor

The vision of quantum computing revolutionizing industries is not merely a futuristic fantasy; it is rapidly becoming a tangible reality. While the journey from niche research to mainstream application is still unfolding, the foundational work being done by companies like those discussed is critical. For investors with a keen eye on the future and a strategic approach, quantum computing stocks present a compelling, albeit risky, pathway to substantial wealth creation.

The current high valuations reflect the market’s anticipation of exponential growth. While these companies are currently generating steep losses and relatively small revenues, their potential to absorb smaller peers and expand at even faster rates as the market matures is a powerful motivator for early investment. The opportunity to participate in the “next big thing” in technology seldom comes without significant upfront speculation.

Ultimately, the decision to invest in quantum computing stocks boils down to an individual’s risk tolerance and long-term conviction. For those who can tune out the near-term market noise, embrace the volatility, and focus steadfastly on the long-term potential of the quantum computing market, the rewards could be truly transformative. Patience, continuous learning, and a strategic allocation of capital will be your most valuable assets on this exciting investment frontier, potentially leading to significant wealth gains as quantum technology reshapes our world.

Frequently Asked Questions

How can I mitigate the high risk of investing in quantum computing stocks?

To mitigate the high risk associated with these speculative investments, consider allocating only a small percentage of your overall portfolio to quantum computing stocks. Diversify your investments across several companies within the sector, and ensure your broader portfolio includes more stable, established assets. A long-term investment horizon, typically 10 years or more, is also crucial, as it allows time for the technology and market to mature.

Is it too late to pursue wealth from quantum computing investments?

While some quantum computing stocks have already seen significant appreciation, the market is still in its early stages of development. Analysts project substantial growth for the global quantum computing market over the next decade, indicating that significant opportunities for wealth creation may still exist for new investors. The key is to conduct thorough due diligence, understand the long-term potential, and be prepared for continued volatility.

What are the primary technological risks affecting quantum computing stock performance?

The primary technological risks include the uncertainty of which quantum computing architecture (e.g., electron-driven, ion-trap, photonic) will ultimately become dominant. Challenges also persist in making quantum computers cheaper, smaller, more scalable, and less prone to errors. Any delays in overcoming these technical hurdles or a competitor’s breakthrough could significantly impact the performance of individual quantum computing stocks.

Why do quantum computing stocks often have such high valuations compared to their current revenue?

Quantum computing stocks typically trade at high valuations because investors are pricing in the immense future growth potential and the disruptive impact of the technology, rather than current profitability or modest revenues. These valuations reflect the expectation of exponential expansion as quantum computing moves from niche research to mainstream applications. This implies a significant portion of their anticipated future success is already factored into today’s stock prices.

How does quantum computing differ from traditional computing, and why is this important for wealth building?

Quantum computers use qubits, which can exist in multiple states simultaneously (superposition) and interact in complex ways (entanglement), allowing them to solve certain problems exponentially faster than traditional binary computers. This revolutionary capability is crucial for wealth building because it can unlock solutions to previously intractable problems in finance, medicine, and materials science, creating vast new markets and driving significant value for investors in pioneering quantum computing stocks.