Global pension funds reassess U.S. Treasury holdings amidst fiscal concerns. Discover how these shifts impact your personal investment strategy and long-term wealth stability.

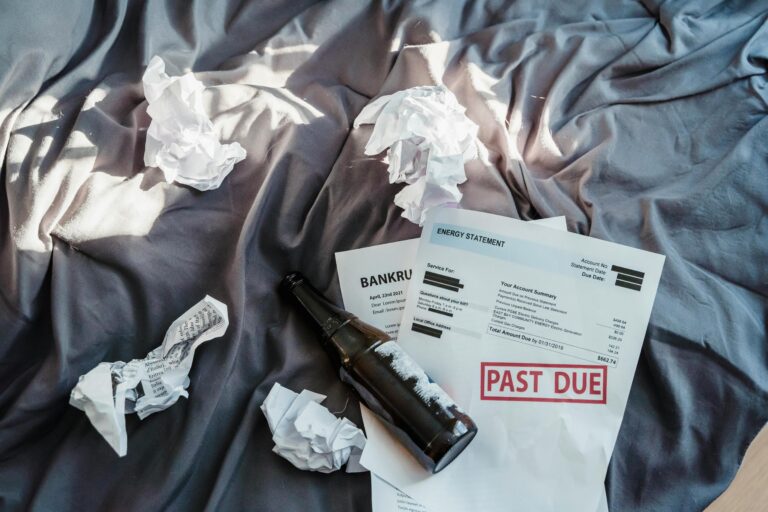

Recent news from a major news outlet highlighted a significant move by a prominent Danish pension fund: its decision to divest approximately $100 million in U.S. Treasurys. This strategic shift, driven by concerns over what its investing chief termed “poor U.S. government finances,” serves as a stark reminder for individual investors about the evolving landscape of global economics and its direct implications for personal wealth building. The decision by AkademikerPension, an academics-focused fund, underscores a growing apprehension within institutional finance regarding America’s escalating national debt and budget shortfalls. While the fund’s chief noted that the move was not directly tied to rising geopolitical tensions, he admitted these factors certainly made the decision easier to execute. This event, alongside a recent downgrade of the U.S. sovereign credit rating by a leading agency, prompts a crucial examination of how such macro-financial indicators should inform your approach to investing, risk management, and safeguarding your financial future.

Understanding the implications of a major pension fund divesting from U.S. Treasurys requires a deep dive into the underlying reasons and their potential ripple effects. For decades, U.S. Treasurys have been considered the benchmark for “risk-free” assets globally, a cornerstone of conservative investment portfolios, and a safe haven during times of market turbulence. The notion of a significant institutional investor questioning this fundamental premise is a potent signal that individual investors cannot afford to ignore. It compels us to reassess traditional investment paradigms and consider how sovereign debt risk, once seemingly distant, could influence our personal balance sheets.

The core issue cited by the Danish pension fund is the “poor U.S. government finances.” This refers primarily to the nation’s ballooning national debt and persistent budget deficits. Last year alone, the U.S. recorded a budget shortfall exceeding $1.78 trillion. This figure, while slightly down from the previous year due to various economic shifts, remains a substantial burden. When a government consistently spends more than it collects in revenue, it must borrow to cover the difference. This borrowing typically involves issuing new bonds, such as U.S. Treasurys. The accumulated effect of years of such borrowing leads to a rapidly expanding national debt. The concern among sophisticated investors like pension funds is not just the absolute size of this debt, but its sustainability and the government’s ability to service it, especially as interest rates rise.

A crucial development underscoring these concerns was the decision by a major credit rating agency, Moody’s Ratings, to cut the United States’ sovereign credit rating from Aaa to Aa1 in May. This downgrade, citing the budget deficit and the high borrowing costs associated with rolling over debt at elevated interest rates, directly impacts how the world perceives the creditworthiness of the U.S. government. While still considered a high-quality rating, any downgrade from the top tier sends a clear message about increasing financial risk. For institutional investors, such rating changes can trigger mandates to re-evaluate asset allocations and reduce exposure to perceived risks. For individual investors, it should prompt similar scrutiny of their own bond holdings and broader portfolio construction.

The concept of “borrowing costs” is particularly pertinent. When interest rates are low, even a large debt can be managed relatively easily. However, in an environment of rising interest rates, the cost of servicing existing debt, and rolling over maturing debt into new issues, increases significantly. This diverts a larger portion of government revenue towards interest payments, leaving less for essential services, infrastructure, or other investments that stimulate economic growth. This spiral can create a vicious cycle, where increasing debt leads to higher interest payments, which in turn necessitates more borrowing, further exacerbating the debt problem. This financial strain can ultimately weigh on economic growth, leading to higher taxes or reduced public services, both of which can impact individual wealth.

Beyond the purely financial metrics, geopolitical tensions are playing an increasingly significant role in investment decisions. The article highlights escalating disagreements between the U.S. and some European nations, including threats of tariffs. While the pension fund’s investment chief stated that the decision was not “directly related to the ongoing rift,” he acknowledged it “didn’t make it more difficult to take the decision.” This nuanced perspective reveals that while fundamental economic concerns are paramount, a deteriorating geopolitical climate can serve as a catalyst for investors to act on those underlying worries. Geopolitical instability introduces a layer of unpredictability that financial markets inherently dislike. It can disrupt trade, create supply chain issues, and even lead to “capital wars,” where nations use their financial holdings as leverage in international disputes. Such an environment elevates market volatility and can lead to sudden shifts in asset prices, making robust risk management more critical than ever.

Ray Dalio, the founder of a prominent global investment firm, echoed these concerns, suggesting that sovereign funds might begin to shed U.S. investments if they no longer view the U.S. as a stable trading partner. He warned of the possibility of “capital wars” emerging on the other side of trade deficits and trade wars, implying that the willingness of international investors to purchase U.S. debt could diminish. This sentiment from a highly respected figure in the investment world adds significant weight to the actions of the Danish pension fund and serves as a clarion call for individual investors to consider the broader implications of global financial shifts on their portfolios.

Market Reactions and Investor Sentiment: What the Signals Mean

The immediate market reactions to such developments are often telling. Following the news of the pension fund’s divestment and the escalating geopolitical rhetoric, Treasury yields in the U.S. and abroad surged. This surge is a clear signal of rising investor anxiety; when bond prices fall, yields rise, indicating that investors are demanding higher compensation for holding government debt perceived as riskier. Concurrently, the U.S. dollar and stocks fell, while gold, traditionally a safe-haven asset, surged to new all-time highs. This pattern, described as a “sell America” trade, reflects a broader sentiment shift among investors seeking to reduce exposure to U.S. assets and move towards perceived safer alternatives or traditional hedges against uncertainty.

For individuals building wealth, these market signals are not merely abstract economic data points. They have direct consequences for various aspects of personal finance:

- Interest Rates: Surging Treasury yields can lead to higher interest rates across the economy, impacting mortgage rates, auto loans, and other forms of consumer credit. If you’re planning to borrow, higher rates mean higher costs. If you’re saving, while higher rates on deposit accounts can be beneficial, they might not keep pace with inflation or compensate for increased market volatility.

- Investment Portfolio Performance: A decline in U.S. stocks and the dollar can directly erode the value of domestic equity holdings and reduce the purchasing power of dollar-denominated assets. This underscores the importance of diversification beyond purely U.S.-centric investments.

- Inflation Concerns: The persistent budget deficit and national debt can contribute to inflationary pressures. When governments print money or borrow excessively, it can dilute the value of the currency, leading to higher prices for goods and services. Protecting your wealth against inflation is a critical component of long-term financial planning.

- The “Risk-Free” Myth: The events challenge the long-held belief that U.S. Treasurys are entirely risk-free. While they carry minimal default risk compared to corporate bonds, they are still subject to interest rate risk, inflation risk, and now, increasingly, sovereign credit risk, even if perceived to be low.

Re-evaluating Your Investment Strategy in an Evolving Landscape

The actions of institutional investors often foreshadow broader market trends. For the diligent individual investor on the path to wealth, this development serves as a powerful prompt to re-evaluate and potentially recalibrate your own investment strategy. It’s not about panic selling, but about informed decision-making and proactive risk management.

1. Assess Your Exposure to Government Bonds

Many diversified portfolios include a significant allocation to bonds, often including U.S. Treasurys, for stability and income. Take stock of your current bond holdings. Understand the duration, credit quality, and specific types of bonds you own. If you hold bond funds, examine their underlying assets. While a complete divestment might be too drastic for most individual investors, understanding your exposure is the first step.

2. Diversification Beyond Borders and Traditional Bonds

The traditional 60/40 stock-bond portfolio might need nuanced adjustments. Consider broadening your bond diversification beyond just U.S. government debt. This could include:

- International Government Bonds: While not without their own risks, investing in government bonds from other financially stable nations can provide geographic diversification.

- Corporate Bonds: High-quality corporate bonds from reputable companies can offer competitive yields and a different risk profile than government bonds. Look for investment-grade ratings.

- Municipal Bonds: For U.S. investors, municipal bonds can offer tax-exempt income, making them attractive, especially for those in higher tax brackets.

- Inflation-Protected Securities (IPS): These bonds are designed to protect investors from inflation by adjusting their principal value based on changes in a consumer price index.

Furthermore, ensure your equity portfolio is also well-diversified geographically. Investing in international stocks can provide exposure to different economic cycles and reduce reliance on any single national economy.

3. The Role of Alternative Assets

As traditional safe havens become less certain, alternative assets might warrant increased consideration, albeit with careful due diligence. These could include:

- Real Estate: Direct ownership or through Real Estate Investment Trusts (REITs) can offer income and potential appreciation, often acting as an inflation hedge.

- Commodities: Gold, as seen in recent market movements, often serves as a hedge against economic uncertainty and inflation. Other commodities might also play a role, depending on your risk tolerance and market outlook.

- Private Equity/Debt: For accredited investors, these options can offer diversification from public markets, though they come with higher illiquidity and risk.

It’s crucial to remember that alternatives often come with their own set of risks, including illiquidity and complexity. They should only constitute a small portion of a well-diversified portfolio, chosen after thorough research.

4. Emphasize Quality and Financial Health

In times of heightened uncertainty, the quality of your investments becomes paramount. For stocks, focus on companies with strong balance sheets, consistent earnings, and sustainable competitive advantages. For bonds, prioritize issuers with solid credit ratings. Avoid speculative investments that are highly sensitive to market sentiment or economic downturns.

5. Maintain Adequate Liquidity

Having an emergency fund covering 3-6 months of living expenses in easily accessible, low-risk accounts (like high-yield savings accounts or short-term certificates of deposit from recognized financial institutions) is always wise. In volatile times, liquidity provides peace of mind and prevents forced selling of investments at inopportune moments.

6. Consult a Qualified Financial Advisor

Navigating complex global financial shifts requires expertise. A reputable financial advisor can help you assess your current portfolio, understand your risk tolerance, and align your investment strategy with your long-term wealth goals in light of macro-economic developments. They can provide personalized advice and help you avoid emotional decision-making driven by market headlines.

The Long-Term Perspective: Building Wealth Amidst Change

The journey from work to wealth is rarely a straight line; it’s characterized by market cycles, economic shifts, and unforeseen global events. The current scrutiny over U.S. government finances and the actions of institutional investors like AkademikerPension underscore the need for adaptability and a robust, long-term perspective. While short-term market reactions can be alarming, focusing on your long-term objectives is crucial. Volatility is a normal part of investing. What matters is how you prepare for it and react to it.

For those building wealth, consistent saving and investing, combined with regular portfolio reviews and strategic rebalancing, remain foundational principles. This recent development is not an indictment of the U.S. economy’s long-term strength or resilience, but rather a reminder that no asset, no matter how traditionally stable, is entirely immune to scrutiny or shifting investor sentiment. It highlights the dynamic nature of global finance and the interconnectedness of national economies. Your ability to understand these dynamics and adjust your strategy accordingly will be a key determinant in your long-term financial success.

Consider the broader historical context. Sovereign debt issues are not new. Nations have faced periods of fiscal stress throughout history. The strength of institutions, the ability to enact reforms, and the dynamism of the underlying economy are critical factors in resolving such challenges. While the U.S. faces significant fiscal hurdles, its economy remains one of the largest and most innovative in the world, with deep and liquid capital markets. However, complacency is not an option for individual investors. Proactive engagement with financial news, critical thinking, and a willingness to adapt your strategy are essential for safeguarding and growing your wealth.

The “Work to Wealth” philosophy emphasizes diligent planning, informed decision-making, and consistent execution. This current global financial environment reinforces the importance of these tenets. Do not let market headlines provoke impulsive decisions. Instead, use them as opportunities for education and strategic review. Empower yourself with knowledge about the forces shaping the global economy, and understand how those forces translate into risks and opportunities for your personal financial journey. The objective is not to perfectly predict the future, but to build a resilient portfolio that can weather various economic conditions and continue to grow towards your ultimate financial goals.

Ultimately, the divestment by the Danish pension fund is a call to action for every investor. It is a signal to look beyond the immediate returns and delve into the fundamental health of the assets you hold, the global economic forces at play, and the potential implications for your financial future. By staying informed, diversifying thoughtfully, and consulting with trusted financial professionals, you can navigate these complex waters and continue your path toward enduring wealth.

Frequently Asked Questions

Does the U.S. debt concern mean my retirement savings are at risk?

While the U.S. national debt is a significant concern for institutional investors and can impact the broader economy, it doesn’t automatically mean your entire retirement savings are at immediate risk. Most retirement portfolios are diversified across various asset classes, not solely U.S. government bonds. The concerns primarily highlight the need for investors to review their portfolio’s exposure to specific types of bonds and consider broader diversification. It’s a prompt to be vigilant, not to panic. Consulting a financial advisor can help assess your specific situation and ensure your retirement plan remains robust.

Should I sell all my U.S. Treasurys and other government bonds now?

Impulsively selling all your U.S. Treasurys or government bonds might not be the best strategy. U.S. Treasurys still play a role in portfolio diversification for many, offering relative stability compared to equities. The decision by a pension fund reflects institutional strategy and risk assessment, which may differ significantly from an individual’s financial goals and risk tolerance. Instead of selling everything, consider reviewing your overall asset allocation, evaluating the role of bonds in your portfolio, and exploring ways to diversify your bond holdings globally or into other credit-worthy instruments. A gradual rebalancing, if appropriate for your financial plan, is generally more advisable than sudden, drastic changes.

How can I protect my investments from geopolitical tensions and “capital wars”?

Protecting investments from geopolitical tensions and potential “capital wars” involves enhancing portfolio resilience through robust diversification. This means not only diversifying across different asset classes (stocks, bonds, real estate, commodities) but also diversifying geographically. Investing in international markets can reduce your reliance on any single country’s economic or political stability. Additionally, holding some safe-haven assets like gold, maintaining adequate liquidity, and focusing on high-quality investments with strong fundamentals can help buffer against market volatility induced by global events. Staying informed and consulting with a financial expert can guide these strategic adjustments.

Will rising U.S. debt impact my mortgage interest rates?

Yes, rising U.S. national debt, combined with large budget deficits and increased borrowing needs, can indirectly impact mortgage interest rates. When the government issues more Treasurys to finance its debt, it increases the supply of bonds, which can push down bond prices and consequently drive up their yields. Mortgage rates are closely tied to the yields on long-term U.S. Treasurys. Therefore, if Treasury yields rise due to fiscal concerns, it’s highly probable that mortgage rates will also increase, making home borrowing more expensive for consumers.

What alternatives to U.S. Treasurys should I consider for stability?

For investors seeking stability and diversification away from U.S. Treasurys, several alternatives can be considered. These include high-quality corporate bonds from financially sound companies, municipal bonds (which can offer tax-exempt income for U.S. investors), inflation-protected securities (IPS) designed to safeguard against rising prices, and government bonds from other economically stable countries. Some investors also explore dividend-paying stocks of mature, financially robust companies or certain real estate investments for their income-generating and potential inflation-hedging qualities. Always assess the creditworthiness of the issuer and how any alternative fits within your overall financial plan and risk tolerance.